If you review the income statement, you see that net income is in fact $4,665. Presentation differences are most noticeable between the two forms of GAAP in the Balance Sheet. Under US GAAP there is no specific requirement on how accounts should be presented. IFRS requires that accounts be classified into current and noncurrent categories for both assets and liabilities, but no specific presentation format is required. Thus, for US companies, the first category always seen on a Balance Sheet is Current Assets, and the first account balance reported is cash.

In Week 3 you learned how to record transactions in T-accounts using debits and credits. This week you will learn the crucial process of ‘balancing off’ each T-account in order to record the correct figure for each account in the trial balance. In Week 4 you will learn how to prepare the trial balance and the balance sheet. You will also learn that balance sheets can be presented in different forms of the accounting equation. An important aspect of your study in Week 4 is to learn that the accounting equation can be expanded to reflect the fact that an increase in profit means an increase in capital for any business.

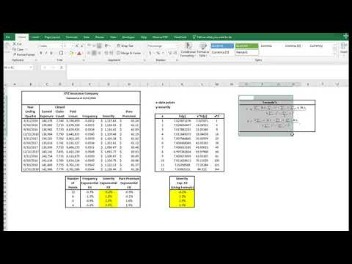

Step-by-Step Procedure to Prepare Balance Sheet from Trial Balance in Excel

If we go back and look at the trial balance for Printing Plus, we see that the trial balance shows debits and credits equal to $34,000. The statement of retained earnings (which is often a component of the statement of stockholders’ equity) shows how the equity (or value) of the organization has changed over a period of time. The statement of retained earnings is prepared second to determine the ending retained earnings balance for the period. The statement of retained earnings is prepared before the balance sheet because the ending retained earnings amount is a required element of the balance sheet. The following is the Statement of Retained Earnings for Printing Plus. Understanding how information flows through your accounting system can help you see where the numbers in your financial statements come from.

The changing role of chief financial officer – Monitor

The changing role of chief financial officer.

Posted: Tue, 22 Aug 2023 07:00:00 GMT [source]

Incidentally, the eliminated accounts are used to construct the income statement. The balance sheet will express the company’s assets, equity, and liabilities. If you take the credit and debit balance statement from the source of the general ledger, it is a trial balance. A trial balance is a statement which lists all the balances of the Real, Personal and Nominal Accounts irrespective of the Capital or Revenue nature of the accounts. If the recording and posting of the transactions take place properly and systematically, then the total of both columns would be identical. Next you will take all of the figures in the adjusted trial balance columns and carry them over to either the income statement columns or the balance sheet columns.

Step #5: Arrange assets and liabilities in proper order

In general, the balance sheet is prepared at the end of the financial year, at one particular date. On the other hand, the profit and loss account tends to be prepared for a particular time period. The balance sheet is classifying the accounts by type of accounts, assets and contra assets, liabilities, and equity. Even though they are the same numbers in the accounts, the totals on the worksheet and the totals on the balance sheet will be different because of the different presentation methods. You will not see a similarity between the 10-column worksheet and the balance sheet, because the 10-column worksheet is categorizing all accounts by the type of balance they have, debit or credit. After transactions are recorded and adjusted for in the general journal, they are transferred to appropriate sub-ledger accounts, such as sales, purchase, accounts receivable, inventory, and cash.

That date may be the end of the financial year, the end of a quarter, or the last day of the month, depending on the period that is being reported on. From the balance sheet statement, you receive the company’s assets, equity, and liabilities summary. The profit and loss account will give an overview of the revenue and expenses of a company.

Step 3: Calculate Liabilities

You want to calculate the net income and enter it onto the worksheet. The $4,665 net income is found by taking the credit of $10,240 and subtracting the debit of $5,575. When entering net income, it should be written in the column with the lower total. You then add together the $5,575 and $4,665 to get a total of $10,240.

FUNDAMENTALS OF DOUBLE-ENTRY BOOKKEEPING – COUNCIL OF ENGINEERS AND VALUERS

FUNDAMENTALS OF DOUBLE-ENTRY BOOKKEEPING.

Posted: Tue, 15 Aug 2023 07:00:00 GMT [source]

For example, managers or a firm’s auditors will likely want to see a detailed listing of all the asset accounts, while executives and external users may only need to see current and non-current assets. Existing assets are items that are already in the form of cash or will likely be converted to cash within a year. Non-current assets are items that are not likely to be converted to cash in the short term. The trial balance is an internal document used as the first step in creating financial statements. It lists all the financial accounts and their ledger balances on a specific date.

You should first comprehend the idea of debits and credits in order to fully comprehend the necessity of matching numbers in the trial balance. In the Printing Plus case, the credit side is the higher figure at $10,240. This means revenues exceed expenses, thus giving the company a net income. If the debit column were larger, this would mean the expenses were larger than revenues, leading to a net loss.

Step 3. Eliminate all Revenue and Expense Accounts

Assets should be arranged in the order of liquidity and liabilities in the order of discharge ability. Accurately recording financial data is a prerequisite for effective financial reporting. But, manual bookkeeping takes much longer and leaves space for human errors. To calculate the sum of liabilities and equity, select cell F12 and write down the following formula. Whatever kind of business you run, you have to close your books at least once a year to prepare an income tax return — or more frequently, if you want to get a better handle on how your business is doing. While in “Trial Balance“, the use of the terms ‘Debit’ and ‘Credit’ is to represent the nature of accounts.

In “Balance Sheet“, use of the terms like Assets and Liabilities indicate what the business owns and what it owes, respectively. Review the annual report of Stora Enso which is an international company that utilizes the illustrated format in presenting its Balance Sheet, also called the Statement of Financial Position. Once this is done, you’ll have a complete balance sheet ready for you. Make sure the balance on the left side matches the balance on the right. Assets whose full value can be reasonably expected to be converted into cash within the accounting year. The computer and bank loan accounts have single entries on one side, like the furniture account, so they need to be treated in the same way.

- Noncurrent liabilities are obligations that will take more than the next 12 months to be repaid.

- Long-term investments whose full value will not be realized within the accounting year.

- The accounting equation is balanced, as shown on the balance sheet, because total assets equal $29,965 as do the total liabilities and stockholders’ equity.

- The balance sheet is one of the most used statements in the modern business world.

Since the terms income statement and profit and loss statement describe a similar meaning, we use both the terms by interchanging throughout the article. In general, the profit and loss (P&L) statement is also known as an income statement. With a balance sheet, you can easily evaluate, analyze and understand your business’s financial health and financial position. Both US-based companies and those headquartered in other countries produce the same primary financial statements—Income Statement, Balance Sheet, and Statement of Cash Flows. Concepts Statements give the Financial Accounting Standards Board (FASB) a guide to creating accounting principles and consider the limitations of financial statement reporting.

Firms will prepare the balance sheet based on the transferred balance from the P&L account. The profit and loss (P&L) statement will describe your business’s earned profit and lost money for the specified period. The main purpose and objective of preparing the trial balance are to make sure that the individual company’s bookkeeping systems are accurate as per the mathematics. Balance Sheet is like a mirror of the business as it shows the status of the company at a particular date, in just one glance.

- Every business – from the solo freelance graphic artist to the Fortune 500 global company – relies on the same basics for tracking their finances.

- In order to do this you will need to follow the four-point procedure that was used to balance off the bank account.

- You should also have an understanding of how transactions are recorded in ledger accounts, and how such accounts are balanced off to prepare the trial balance and the balance sheet.

- Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

In the next activity you will balance off the two accounts that we have not yet dealt with, the liability account ‘Pearl Ltd’ and the capital account. In order to do this you will need to follow the four-point procedure that was used to balance off the bank account. In this activity you will quickbooks self employed vs quickbooks online again not enter the answer in a box but will instead have an opportunity to work out the answer mentally before you click on the ‘Reveal answer’ button. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Introduction of Trial Balance

It is important that you must understand that the two columns must always be the same. The balance sheet is typically made available to shareholders and other financial firms outside the organisation, but the trial balance is just a document that a company uses internally. The trial balance’s main purpose is to determine whether the overall crediting and debits in the accounting records are in line.